A Beginner’s Guide to NFTs: What You Should Know

Assume you received an artwork by Leonardo Da Vinci as a gift. Initially, you might not believe that it was an original work by Da Vinci. You may, however, look for an art expert if the individual who gave you the picture was trustworthy.

Assume you received an artwork by Leonardo Da Vinci as a gift.

Initially, you might not believe that it was an original work by Da Vinci. It is possible to get an art specialist to authenticate the painting given to you by a trustworthy individual. In this case, the professional would come to your house and look at the artwork’s composition. A team of appraisers would be called to see if it was a well-painted imitation if the expert thought it was in Da Vinci’s style. This may seem excessive, but there’s no other way to tell if the artwork is genuine.

A situation like the one described above would not be possible with non-fungible tokens (NFTs). It’s impossible to tell if a piece of digital art is original unless accompanied by an NFT token. An NFT-captured digital artwork will never represent the original. The screenshot will not include the cryptographic token, the NFT. If a duplicate isn’t in the blockchain, anyone can readily recognize it as a fake because it won’t be. This can be verified without a group of experts.

Digital NFT art like Beeple’s can be sold for $69 million because of this. It’s a Beeple original, and we’re sure of it. There can be no disagreement as long as the token is present. As long as he holds Beeple’s daily journal, Metavokan may rest easy at night. When a Rembrandt painting was wrongly assigned to his student for decades, it will never happen again.

We don’t need to tell you why NFTs have taken off worldwide. Let’s take a closer look at the ecosystem to comprehend NFTs better.

Brief History of NFTs

The first so-called non-zero-fee transactions (NFTs) were colored coins on the Bitcoin network. In comparison to today’s NFTs, their functionality was severely constrained, and as a result, they were significantly less effective. They cleared the door for non-fungible tokens to be considered. Coupons, property, subscriptions, and digital collectibles were all represented by colored coins. Even so, this was a brand-new field of study for the time. Colored coins didn’t catch on since a conventional database was easier to use.

It raised awareness about the advantages of storing assets on a blockchain. A peer-to-peer system developed on top of the Bitcoin blockchain called Counterparty was the catalyst for developing non-fungible tokens (NFTs). Counterparty was used to store digital materials and games. Popular NFTs on the platform included Spells of Genesis and Pepe Memes.

Ethereum had begun to take off by the year 2017 rolled around. Known as «Cryptopunks,» the group has become an internet sensation. Soon, these 10,000 distinct figures became sought-after digital memorabilia for fans. Intuitive in design, Cryptopunks were among the first NFTs created on Ethereum. When CryptoKitties debuted in October 2017, it marked a watershed moment in the rise of digital asset ownership. In light of the enormous potential of NFTs, investors like SamsungNEXT and Google Ventures began investing in the technology.

NFT markets like OpenSea and Rarible began gaining traction in 2018 and 2019, allowing anybody to mint their NFT artwork. The Metamask wallet was primarily responsible for this, making it easier to get into the NFT sector. A few years after it was first proposed in 2018, the ERC-721 NFT standard is finally shaping.

Many existing games and applications, such as Decentraland, Crypto Heroes, and Gods Unchained, are made feasible thanks to ERC-721. It’s not simply trading cards and memorabilia that ERC-721 (Ethereum Request for Comments 721) can be used to facilitate. You may print tickets for events, buy digital land, make your gaming gear, create music and video clips, and other things. It’s possible to use these features across multiple platforms thanks to the Ethereum network. Virtual reality museums of NFT art purchased from other platforms, for example, can be found on Decentraland.

Let’s talk about the overall concept of NFTs now that we’ve learned about the history of NFTs.

What does it mean to be fungible?

We must define fungibility to comprehend non-fungible tokens. Fungibility is commonly used in finance to describe goods that are interchangeable and indistinguishable from each other. Fungible objects can also be broken down into smaller pieces.

As a concrete case study, the currency is an excellent example. It is impossible to tell the difference between one $5 bill and another $5 bill in the United States dollar system. USD 5 bill equals five USD 1 bill; USD 20 bill equals four USD 5 bills; and so on. Considered «fungible,» these include Cryptocurrencies are fungible despite their scarcity and high-tech creation. Buying one Bitcoin and selling another is a simple matter of exchanging one cryptocurrency for the other. Furthermore, 0.02 Bitcoins can be exchanged for another 0.02 Bitcoin.

Non-fungible examples

Your cat is most likely distinct from your neighbor’s cat. But even if they are reasonable, both Siamese and your cat may be a bit friendlier and not scratch the couch. Also, a limited-edition Pokemon card isn’t transferable to another player’s collection. Even if two Pikachus from the same edition share the same holographic, one may fetch USD 40,000 at auction while the other fetches USD 80,000. You can’t trade in your car either. Yours might have a lot more miles on it or a nicer interior than another car of the same make and model, making it worth more than a vehicle with fewer miles and more damage.

It’s also impossible to separate cats, cards, and automobiles. Their worth would be drastically altered if they were divided up. You can’t expect a baseball card to be worth the same no matter how it’s broken up. A USD 20 note can be broken down to a USD 1 bill using fungible assets like the US currency. Non-fungible assets are distinct and cannot be substituted for each other.

An NFT’s goal is to transform a digital asset into something like this. It ensures the authenticity of your possessions through the use of cryptographic technology. A piece of artwork, a collectible, or a digital asset has a token linked to it that is exclusively yours. Upland customers who purchase digital assets like Fewocious artwork or online collecting cards can rest assured that they will be the ones to own them. If you want to be certain that you own a specific piece of digital land, you don’t need a ton of paperwork and certification. Ownership of the token is all that is required.

Inquiring minds want to know. What’s the point of investing one’s hard-earned cryptocurrency in these virtual goods? Trying to trade these things for money isn’t the only motive.

Subjective Value

NFTs are valuable because of their subjective worth. There is a market for Gronkowski’s digital Super Bowl card as long as someone thinks it’s worth USD 1.8 million. In a sense, the individual who mints the NFT is digitally signing it. The digital signature of Gronkowski belongs to the buyer in perpetuity. Fans of celebrities will find great meaning in this.

Because NFTs are digital assets, they have the potential to be significantly more secure than tangible objects such as a rare baseball card. For example, your house and card collection could be destroyed in a severe fire. It’s possible that a thief hears about your Babe Ruth card and steals it. This is not an issue with NFTs because the owner is awarded on the blockchain and can be recognized by every machine in the network. This characteristic considerably enhances an NFT’s perceived value.

Brief Rundown of NFT Technology

You may be wondering, «How is this possible?»

To guess and verify the hash (encrypted algorithm) that would give access to the token’s ownership keys, an absurdly powerful computer would be required. It would take an absurd amount of computing power to break the code, making it virtually impossible. It’s also evident to the network when something is wrong with the digital ledger. P2P (peer-to-peer) is a term used to describe this platform type. There is no central authority like a government or bank on these platforms. All of the network’s computers and nodes would have to be destroyed. You just need one copy of the blockchain’s ledger to keep track of all transactions. As a last resort, you may aim to kill every node in a widely utilized blockchain network.

NFTs are coins based on blocks of algorithms that are impossible to comprehend. A fungible cryptocurrency like Bitcoin is not what NFTs are about, as they represent uniqueness and immutability. For each NFT, a cryptographic technique has been used to create an additional layer of uniqueness and scarcity. An item, property, monster, or card’s appearance cannot be changed once assigned to it. The data cannot be edited, forged, or tampered with. When a transaction is made on the blockchain, it is encrypted and is visible to every computer in the network. If you only have one node, with the blockchain ledger saved, you’ll be able to access all of the data that has already been recorded. You won’t lose any data even if your PC abruptly explodes.

A standardization protocol is incredibly beneficial. HTTP is the protocol used on the Internet. Developers of websites don’t have to invent their version of HTTP. They can access the Internet using the HTTP protocol. It is easy to build a standard for NFTs because of the blockchain and the Ethereum ERC-721 that most NFTs are built on. When a weakness is discovered in a network, everyone will be affected. The high gas fees associated with creating or selling NFTs on Ethereum have made newer protocols like Cardano more appealing to investors.

How To Make, Buy, and Sell NFT Art

If you’re an artist, you may wonder how you might join the ranks of digital artists generating millions of dollars. Even though various protocols, including Zilliqa, TRON, Flow, and Cosmos, allow you to mint your own NFTs, the standard ones are on Ethereum. That’s where the incredible sales figures come from. They can be found in the Mintable, Raible, and OpenSea marketplaces.

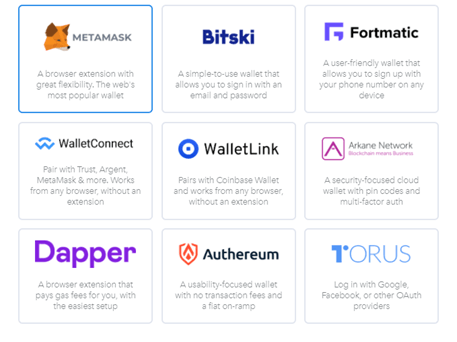

First, you’ll need to link a wallet, the most common of which is Metamask, to create an account. OpenSea supports a variety of wallets, including these.

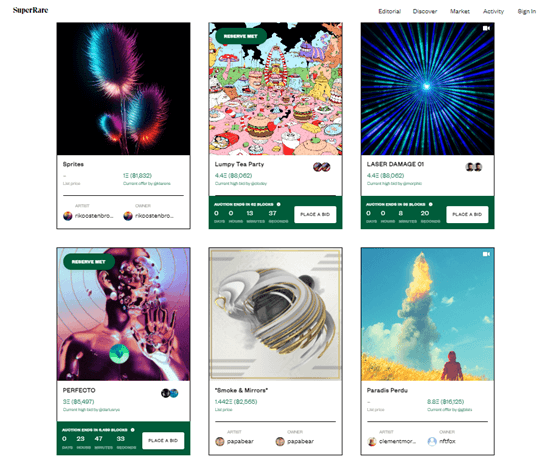

To sell your collection, you can use this application. Using Raible or minting an NFT on OpenSea, you have the option of importing your NFT. Your NFT can be customized after you’ve created a collection of them. These include the number of NFTs that will be produced. A gas fee is required to start the NFT minting process and put it up for auction. Like a museum exhibition, other marketplaces such as Super rare or Nifty Gateway are discriminating. Artwork must be submitted or invited to be displayed in these marketplaces rather than minting it. A marketplace on the Internet lets you place bids on NFTs regardless of whether you’re on a platform that allows you to mint the tokens or not. The NFT artwork will be yours if you win the auction.

The Future of NFTs

You may argue that this is just the beginning of the proliferation of protocols capable of hosting NFTs. NFTs are still in their infancy, and it’s hard to believe. NFTs have only been widely adopted since 2017, less than four years after artists began amassing personal fortunes through their work. Even though NFTs had briefly overtaken Ethereum in search traffic this year, Ethereum is still not a household word compared to Bitcoin’s ubiquity in the cryptocurrency world.

With the introduction of a new protocol for Ethereum this summer, the NFT ecosystem is constantly shifting and expanding as buyers continue to swap NFTs for hundreds of thousands of dollars. No one who cares about the future of art will be able to ignore this fascinating development in the near future.